Israel's Energy Market Setbacks Post “Operation Al-Aqsa Flood”

2023-11-096142 view

Download PDF

Introduction:

The world awoke on October 7 to a military operation conducted by the Palestinian Hamas’ Qassam Brigades against Israeli forces. Named "Operation Al-Aqsa Flood," the Qassam forces managed to breach Israel's defenses situated around the Gaza envelope. This operation prompted fierce responses from the Israeli forces, coupled with threats to dismantle Hamas. This indicates a likely prolonged conflict, naturally leading to security, economic, and political repercussions both regionally and internationally, as well as significant impacts within Israel itself.

This paper focuses on the actual and potential losses for Israel in terms of energy security and the international energy market. Simultaneously, it's possible to reinterpret the war in Gaza through the lens of energy security, shedding light on the dimensions, backgrounds, and impacts of the war locally, internationally, and regionally. It is important to note that analyzing from an energy security perspective does not mean excluding other dimensions of the recent war, such as ideological and geopolitical aspects, alongside the economic and energy dimension that is the primary focus here.

1. Implications of Operation Al-Aqsa Flood on International Energy Markets:

The impacts on international energy markets emerged hours after the "Operation Al-Aqsa Flood," with oil prices in the global market rising by 5%. Although Israel is not an oil exporter, the price hike followed expectations of an expanding war zone, especially if Iran were to intervene directly or indirectly. Such intervention would likely increase tension and instability in the Gulf region, consequently driving up international oil and gas prices. Based on oil market experts' predictions of a production decline, many speculators rushed to buy futures contracts, believing oil prices would soar above $120 per barrel. However, the emergence of implicit U.S.-Iranian understandings to prevent the conflict's escalation relatively restored confidence in the international energy markets, stabilizing prices close to their pre-October 7 levels.

2. Israel's Losses in the International Energy Market Following the Operation:

Naturally, Israel suffered substantial losses on both material and moral levels. Economically, the Israeli economy is expected to enter a recession, with the Shekel losing more than 6% of its value against the US-dollar. The production sector in Israel is experiencing a decline in growth and manufacturing activities and a decrease in the supply of goods due to a labor shortage. This shortage is a result of the Israeli army's decision to mobilize its reserve forces, amounting to 350,000 soldiers. The current war threatens Israel with losses that could exceed 3 billion dollars, as of the completion of this paper [1] . In terms of energy security, Israel's losses are distributed on both domestic and external levels, with the recent operation halting several Israeli energy projects, at least for the current period.

2.1. Losses on the Domestic Level:

In the last decade, Israel has endeavored to develop its infrastructure for domestic gas production, aiming to achieve self-sufficiency and export capability. This was practically achieved with the development of the Tamar and Leviathan gas fields. However, "Operation Al-Aqsa Flood" and the subsequent shelling by the Qassam Brigades inflicted significant losses on Israel's energy sector at the domestic level. The government decided to temporarily suspend gas production in the "Tamar" field, which, along with the "Leviathan" field, is one of the largest gas fields Israel exploits.

Another loss Israel faced due to "Operation Al-Aqsa Flood" is the increased cost of returns from investments by international energy companies in its gas fields. Due to the uncertainty of Israel's security situation, these companies may demand higher profit returns to mitigate the risks associated with military attacks. Naturally, this situation leads to losses in Israel's energy sector due to the elevated profit returns demanded by the energy companies.

One of the most significant internal losses for Israel was the halt of operations at the "Ashkelon" [2] port following the Qassam Brigades' rocket attacks targeting the city of Ashkelon. This port is crucial from an energy security perspective, as Israel relies entirely on it for receiving oil shipments from international markets. The Israeli government was forced to redirect oil shipment receptions to the port of Haifa, leading to increased shipping costs. This rise in costs was due to two main factors: the change in shipping routes and the heightened insurance premiums imposed by international insurance companies following the shelling of areas where Israeli forces are present.

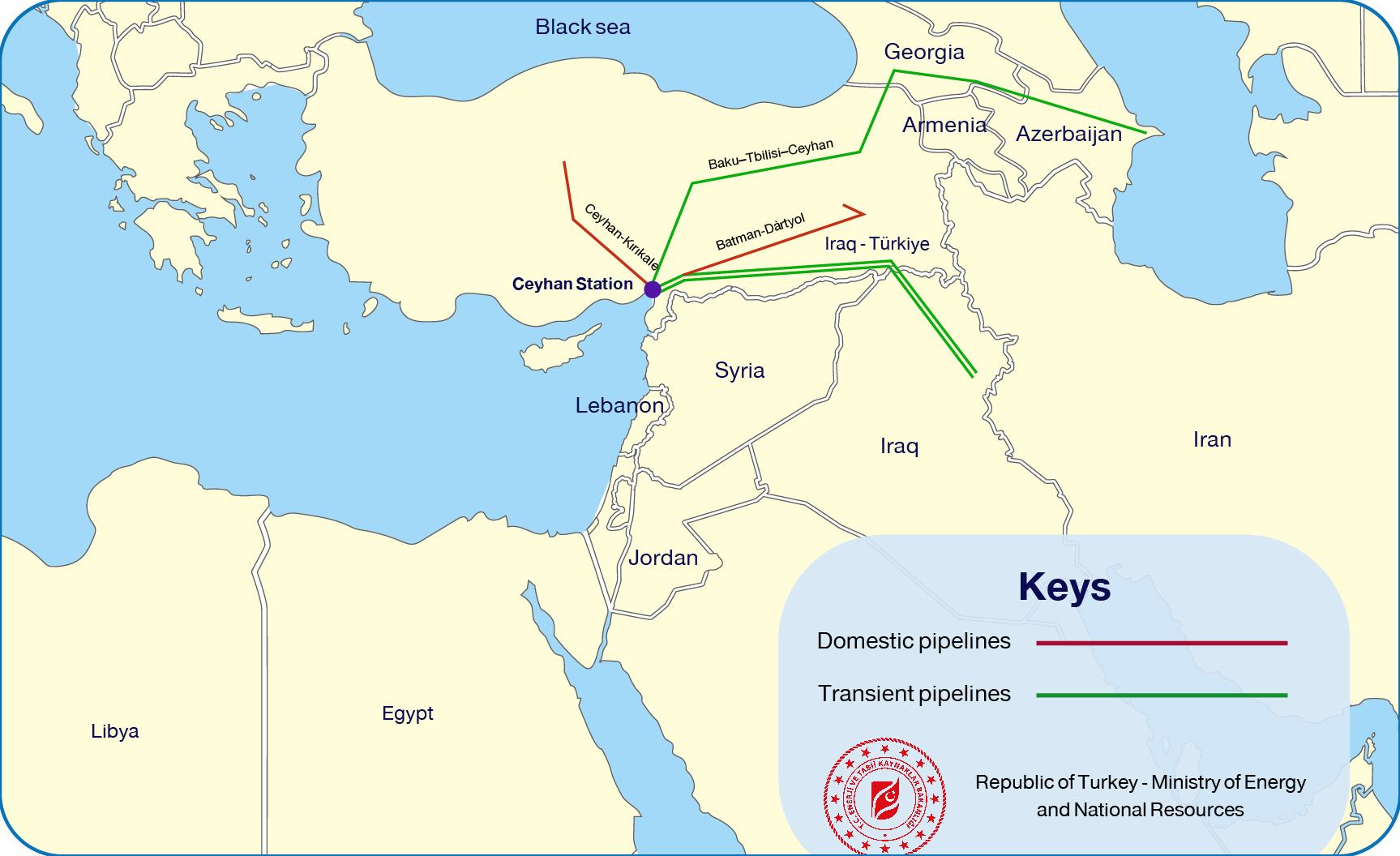

In March 2023, Israel found itself in a tight spot, losing its lifeline of oil supplies from the Kurdistan Region of Iraq. This oil, which once flowed freely through the Ceyhan pipeline, traversing the Turkish landscape, before making its way to Israel's shores via sea-bound oil tankers, suddenly hit a roadblock. The root of the problem? A tangled web of disputes – a tug-of-war between Turkey and Baghdad's [3] central government, further complicated by disagreements with the Kurdistan Regional Government.

Israel, however, didn't just sit back. Swiftly pivoting, it turned to other sources to fill the void. Azerbaijan emerged as a key player, its oil reaching the Ceyhan port through a serpentine network of pipelines. To paint a clearer picture, imagine a map with lines crisscrossing like arteries – the Kirkuk-Ceyhan and Baku-Ceyhan pipelines[4], symbolizing not just routes of oil but also of geopolitical chess.

Map (1) Kirkuk-Ceyhan and Baku-Ceyhan pipelines

2. 2 Losses on the International Level:

Following Israel's decision to suspend gas production in the Tamar field, its gas exports to international markets plummeted by 70%. [5] Israel is known to export its gas through Egypt via the Arish pipeline, which links the production sites to the Damietta liquefaction station, from where it's then exported to the European market. [6] When Israel stopped pumping gas to Egypt, it lost its share in the international markets. This loss is significant; in the world of international energy markets, once a producer loses its market share, it often takes a considerable amount of time to secure new markets, unless there's an increase in demand or a shortage in supply.

One of the most significant potential losses Israel could face on the international stage is the East Mediterranean Gas Pipeline project. The concept of this ambitious project was put on hold following "Operation Al-Aqsa Flood." This suspension could extend indefinitely if the threat of similar future operations by Hamas continues to loom. The East Mediterranean Gas Pipeline was envisioned as a key infrastructural development, not just for Israel but for the broader region, aimed at enhancing energy cooperation and security. Its stalling represents not only a missed economic opportunity but also a setback in regional energy diplomacy.

The East Mediterranean Gas Pipeline project stands as Israel's bold geostrategic bridge to Europe, tying the continent's energy security more closely to its own. Israeli policy-makers, recognizing this golden opportunity, have been actively mobilizing lobbyists in both the United States and the European Union. Their mission? To champion the cause of a pipeline stretching from Israel's control-rich gas fields in the Eastern Mediterranean straight to the heart of Europe.

Israel's recent endeavors have been marked by a robust campaign to win over EU and US leaders. Their persuasive narrative hinges on a global shift – the urgent need to reduce reliance on Russian gas. Israel, in this grand chess game of energy politics, positions itself as a crucial alternative, capable of stepping in to fill the void left by Russian gas. This is more than just pipelines and gas flows; it's a strategic play in the high-stakes game of international relations and energy diplomacy.

The East Mediterranean Gas Pipeline project previously faced rejection from European Union countries due to its lack of economic feasibility [7] , with costs potentially exceeding $7 billion [8] . The main reason was that Israel's gas reserves are modest compared to major suppliers to Europe like Russia, Algeria, Norway, and the United States. For the project's success, other gas-producing countries alongside Israel, both geographically and politically viable, are needed.

The United Arab Emirates and Egypt emerge as fitting partners for the East Mediterranean Gas Pipeline project. The UAE, with the world's seventh-largest confirmed natural gas reserves estimated at about 7 trillion cubic meters [9] , had previously not focused on gas production. However, they later announced significant projects to develop and produce gas, expected to be completed by 2025. Gas-producing countries typically don't embark on production or expansion projects without pre-signed sales agreements for parts of their future production. The UAE has not yet signed international agreements for future gas sales, potentially making it advantageous for them to export through a pipeline connected to the Ashkelon line. This new pipeline might run parallel to the recently announced "India-Europe" route through the Middle East. For illustration, Map (2) shows the anticipated pipeline route between the UAE and Israel, and the East Mediterranean pipeline.

Egypt, on the other hand, continues to discover gas in the Eastern Mediterranean waters. It is already connected to Israel through the Arish pipeline. Only in this scenario, as indicated in the paper, does the East Mediterranean Gas Pipeline project become economically viable. However, economic feasibility doesn't guarantee the project's execution due to technical obstacles around the passage of the pipeline through Eastern Mediterranean countries, which have yet to agree on exclusive maritime borders. There's a deep-rooted territorial dispute between Greece and Cyprus on one side and Turkey and Northern Cyprus on the other. [10]

Map (2) The expected pipeline between the UAE and Israel and the Eastern Mediterranean Pipeline

3. The Impact of the Recent Conflict on Stakeholders from an Energy Security Perspective

It's crucial to recognize that monitoring the backgrounds and implications of "Operation Al-Aqsa Flood" from an energy security perspective is essential. This importance stems from its role as a fundamental factor alongside a number of security, political, ideological, and doctrinal elements linked to the recent conflict. This perspective underscores the multi-dimensional nature of the conflict, where energy security intersects and interacts with broader geopolitical and ideological concerns, shaping the overall dynamics and outcomes of the situation.

The recent operation by Hamas seems to align with Russian interests, to the extent that there's speculation Russia may have turned a blind eye to certain facilitations for Hamas, possibly contributing to the operation's execution. Recent revelations have shown that Russia facilitated Hamas' purchase of cryptocurrencies from Russia in the period leading up to "Operation Al-Aqsa Flood." Millions of dollars were transferred through "Garantex," a cryptocurrency exchange based in Moscow [11] .

In an interview with the Russian channel RT in Arabic, a Hamas official stated, "Hamas obtained a license from Russia to locally produce bullets for Kalashnikov rifles, and Russia sympathizes with Hamas. Russia is happy with the war because it alleviates American pressure on it regarding the war in Ukraine." This statement, if accurate, suggests a complex web of international relations and interests, where global conflicts like the one in Ukraine intersect with regional dynamics in the Middle East, influencing actions and strategies of various actors. [12]

The battle appears to have relieved pressure on Russia in its war against Ukraine. Following "Operation Al-Aqsa Flood," global attention, particularly from the European Union, the United Kingdom, and the United States, shifted towards Israel. These countries rushed to provide military support to Israel, including the United States sending aircraft carriers loaded with troops and officers. As a result, a significant portion of Western military, political, and even media support transitioned from Ukraine to Israel.

This shift highlights the fluid nature of international relations and the interconnectedness of global conflicts. The focus on Israel's situation, catalyzed by the recent operation, underscores how regional conflicts can have broader geopolitical ramifications, affecting the distribution of global attention and resources. This dynamic is especially relevant in the context of the intense international focus previously centered on the conflict in Ukraine.

Additionally, it aligns with Russia's interests to create obstacles around the implementation of the East Mediterranean Gas Pipeline project by Israel and its allies. Fundamentally, this project poses a threat to Russian gas exports to Europe. It is vital to note that Russia aims to maintain its monopoly in the European gas market due to its significant economic and political importance. Keeping Europe dependent on Russian gas allows Russia to retain it as a constant pressure point.

Until now, it can be argued that European Union countries haven't found an alternative capable of adequately replacing Russian gas. This situation underlines the strategic importance of energy resources in global politics and the complex interplay between regional projects like the East Mediterranean Gas Pipeline and broader international power dynamics. Russia's influence in the European energy market thus remains a critical factor in understanding these geopolitical tensions and the challenges faced in diversifying energy sources.

Conclusion:

Following "Operation Al-Aqsa Flood" conducted by the Qassam Brigades, Israel has incurred what can be described as "severe" losses from an energy security perspective. The operation led to the suspension of international companies' activities in the "Tamar" field, significantly diminishing Israel's share in the international gas market. Moreover, the recent war might erode global confidence in Israel as a gas producer and exporter. The disruption at the Ashkelon port has led to increased oil import costs and higher insurance premiums for incoming shipments to Israel under the threat of rocket attacks.

It's evident that "Operation Al-Aqsa Flood" and the ensuing Israeli offensive in Gaza have regional and international dimensions related to the energy security interests of regional and global actors. For years, Israel has been vigorously pursuing the East Mediterranean Gas Pipeline project to bolster its security and enhance its geopolitical and economic significance. However, this project continues to face various technical and geopolitical challenges. If successful, the pipeline could negatively impact Russia, which has historically opposed many pipeline projects aimed at Europe since 1992, such as the "Nabucco" pipeline from Azerbaijan and Turkmenistan to Europe via Turkey, a pipeline connecting Qatar to Turkey via Syria, and an Iranian pipeline through Iraq and Syria to the Eastern Mediterranean [13] .

Given Russia's history of obstructing such projects, it's not far-fetched to envision Moscow's potential involvement in supporting Hamas in some way to hinder the East Mediterranean pipeline and even the recently announced Indian route to Europe through the Middle East, a competitor to China's Belt and Road Initiative. Thus, future developments in Hamas-Russia relations based on mutual interests are not improbable, with Hamas seeking support from a major power and Russia needing tools to prevent the emergence of anticipated Israeli energy pipeline projects.

To read the full report in Arabic: (Click the link)

References

[1] The GazaWar Triggers Economic Downturn in Israel," Al Jazeera Net, October 28, 2023, Link

[2] Israel Halts Production at Tamar Field Amid Talks of Ashkelon Port Closure," Al Jazeera Net, October 9, 2023, Link .

[3] Months of Suspension and Years of Disputes: What is the Iraqi-Turkish Oil Pipeline?" Alhurra, October 2, 2023 Link .

[4]Where Does Israel Source Its 220,000 Barrels of Oil Daily?" Economy East with Bloomberg, October 18 Link

[5] Israel's gas exports plummeted by 70% as a result of the war, Al Jazeera Net, November 2, 2023. Link .

[6]The Gaza war halts the Israeli Tamar field and threatens Egypt's plans to export gas. CNN Economics, October 10 Link

[7] Rethinking Gas Diplomacy in the Eastern Mediterranean," International Crisis Group, April 2, 2023, Link

[8] Staff, T. Israel, cyprus, Greece and Italy agree on $7B. EastMed gas pipeline to Europe, The Times of Israel, 24 November 2018, Available at: Link

[9] U.S. Energy Information Administration - EIA - independent statistics and analysis, International - U.S. Energy Information Administration (EIA), 28 August 2023, Available at: Link

[10] Khaled Alterkawi's Scenarios of the Energy Conflict in the Eastern Mediterranean,"DSS” , August 25, 2021 Link .

[11] Đokić, A. The israel-hamas war is the latest proof Russia is an agent of Chaos, euronews, 18 October 2023, Available at: Link .

[12]Ibid

[13] OKÇUOĞLU, İ. Ortadoğu CEHENNEMİ - Dar Alanda Jeopoli̇ti̇k ‘i̇t dalaşi’, ORTADOĞU CEHENNEMİ - DAR ALANDA JEOPOLİTİK ‘İT DALAŞI’, 31 October 2015, Available at: Link